Adrian in

Saving on

Dec 10th, 2012 |

no responses

When I?m not blogging, you can often find me hanging around on Quora, the brilliant question and answer site ?

When I?m not blogging, you can often find me hanging around on Quora, the brilliant question and answer site ?

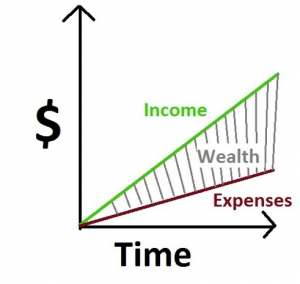

? and, that?s where I found Chris Han?s personal finance chart (to the left).

Chris says:

- Wealth is the shaded area in the diagram.

- You can increase the shaded area by increasing the slope of the green line, or by decreasing the slope of the red line.

- Decreasing the slope of the red line becomes significantly harder over time as you grow accustomed to your lifestyle.

Chris is right, but he needs to add a 4th bullet-point, and it?s the same observation that I made when I used a similar chart in this post to explain how businesses should manage their finances for growth:

4.?Notice that it is easier to grow Wealth dramatically by increasing the slope of the green Income line than it is to decrease the slope of the red Expense line.

So, let?s break this down ?

Regular personal finance will tell you to concentrate on the red (expense) line.

These authors will say that frugality, paying yourself first, and debt reduction (thereby, reducing your interest expense) will increase your wealth through the combined effect of:

- Decreasing expenses, and

- Time.

Decreased expenses allow you to save more, and time allows the full effect of compounding.

Voila!?40 years to fortune!

But, I think that you give up too much for too little, if you follow their advice:

First of all, you give up too many of life?s little pleasures now for little-to-no-reward later (if you can?t afford the lattes now, you sure won?t be able to in retirement).

Next, you have to wait ? hence work ? for far too long.

Instead, you should focus on the line that they are missing: the green (income) line. If you take my advice, you will concentrate on:

- Increasing your income,

- Using that increased income to build up a larger investment pool, quicker,

- And, aim to get better returns (hence, even more income) through better ? and, more leveraged (i.e. using even more debt) ? investments

Of course, you can?t simply ignore expenses, but they are best kept in control through delayed gratification, which means:

- Waiting to make purchases; the more major, the longer you should wait, and

- Not increasing your lifestyle (hence expenses) as your income increases.

It is this combination ? increased/reinvested Income and controlled/slow-growth Expenses ? that can quickly create a huge wedge of Wealth.

This is a very useful chart ? you will do well to remember it.

Source: http://7million7years.com/2012/12/10/the-only-personal-finance-chart-you-need/

mary louise parker cher morgellons nhl all star draft seal team 6 touch nitrous oxide

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.